Enabling Tax Payments

Payments on PhonePe are safe, reliable and fast.

One in four Indians, 500 Million+ users use the PhonePe app to send money, recharge, pay bills and do so much more, in just a few simple clicks.

My Role

Responsible for driving user research, proposing the project, conceptualisation, design, and delivery of key modules and feature areas.

The Team

Me working as a solo product designer with a user researcher, product manager, engineers, copywriter, graphic designer and a motion designer

Project Overview

India has a complex tax system with various types of taxes imposed at the central, state, and local levels. Enabling tax payments on the mobile app is essential for providing users with an accessible way to fulfill their tax obligations. Offering the convenience of paying taxes on the app not only improves the user experience but also makes the whole process much simpler, eliminating the need for professional assistance.

Research & Findings

Direct taxes are taxes that are levied directly on individuals, businesses, or other entities. These taxes are paid by the person or entity on whom they are imposed.

Income Tax

Tax on an individual's or business's income. Tax

Corporate Tax

Tax on the profits earned by businesses

Property Tax

Tax on the value of real estate owned by an individual or entity.

Who Pays?

In direct taxes, individuals or entities pay the tax directly to the government,

while in indirect taxes, the tax is collected by businesses from consumers and then remitted to the government.

How people pay taxes currently ?

Online Payment

Many taxes, including income tax, can be paid online through the official websites of the respective tax authorities.

Physical Payment

Taxpayers can visit designated bank branches or authorized collection centers to make physical payments.

Tax Professionals

Tax consultants or chartered accountants can assist taxpayers in preparing and filing taxes, and they often facilitate the payment process on behalf of their clients.

Market Study

Filing taxes refers to the process of submitting your income details, deductions, and other relevant financial information to the tax authorities. It involves completing the necessary forms, such as the Income Tax Return (ITR) form in India, and providing an accurate account of your financial activities for a specific assessment year.

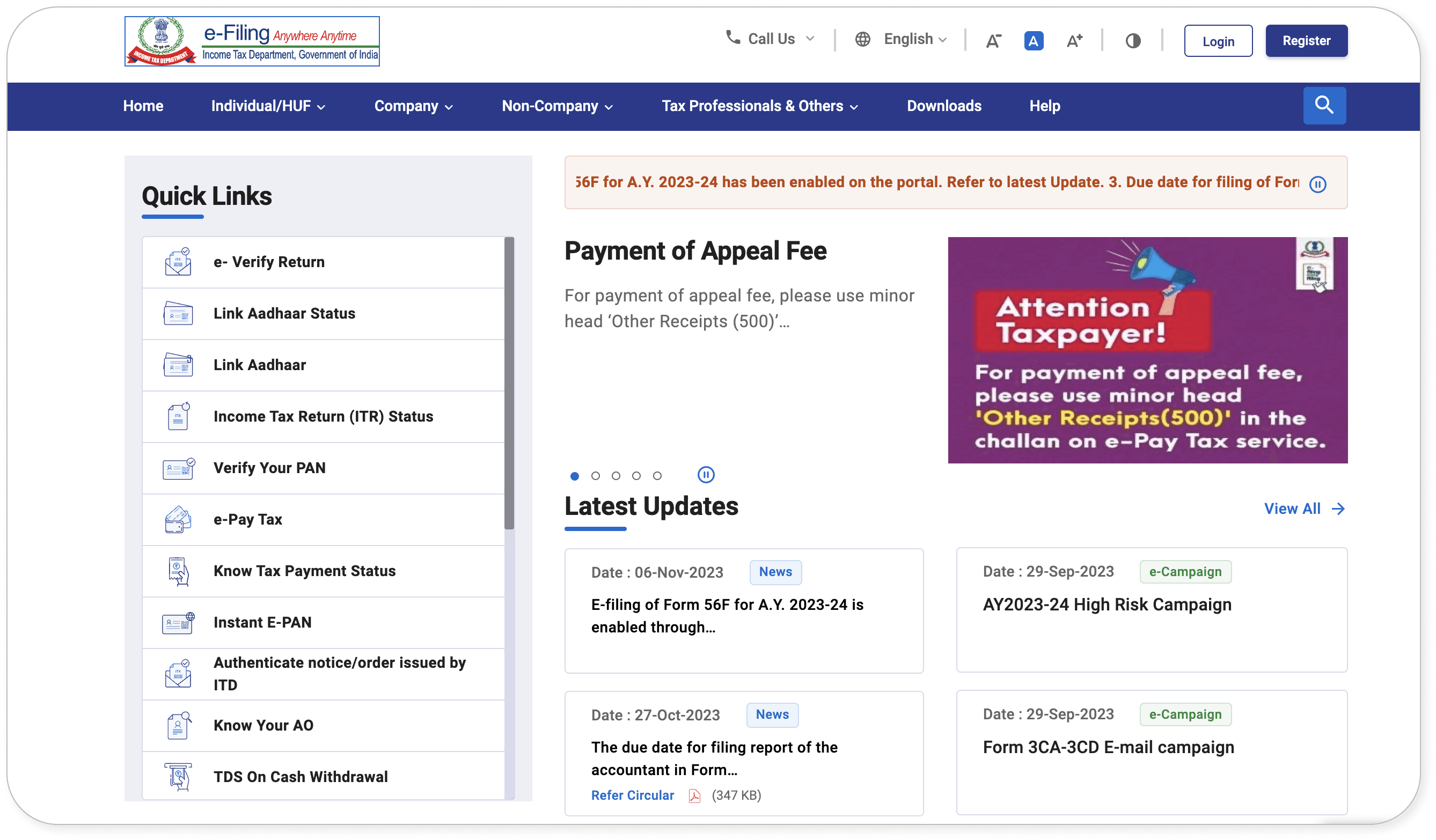

Government Income Tax Web Portal

By Tax Department of India

Clear Tax

Tax2win

Quicko

Users can e-file income tax returns, make tax payments, verify ITR-V, check refund status, link Aadhar and PAN, apply for PAN/TAN, file TDS returns, respond to notices, access forms/utilities, apply for a Digital Signature Certificate, and get information on tax laws on the Indian government's online tax payment portal.

Key Insight

There are no other ways for the users to Pay their taxes online apart from Gov. Income Tax Portal, in a convenient way and with easy navigation.

Tax Filling Proccess

User Persona

Limited Feedback Mechanism

Complex Navigation

Limited User Guidance

Insufficient User Education

Confusing terminology

Complex Payment Process

Limited Access to PC's and Laptops

Insights and Pain points

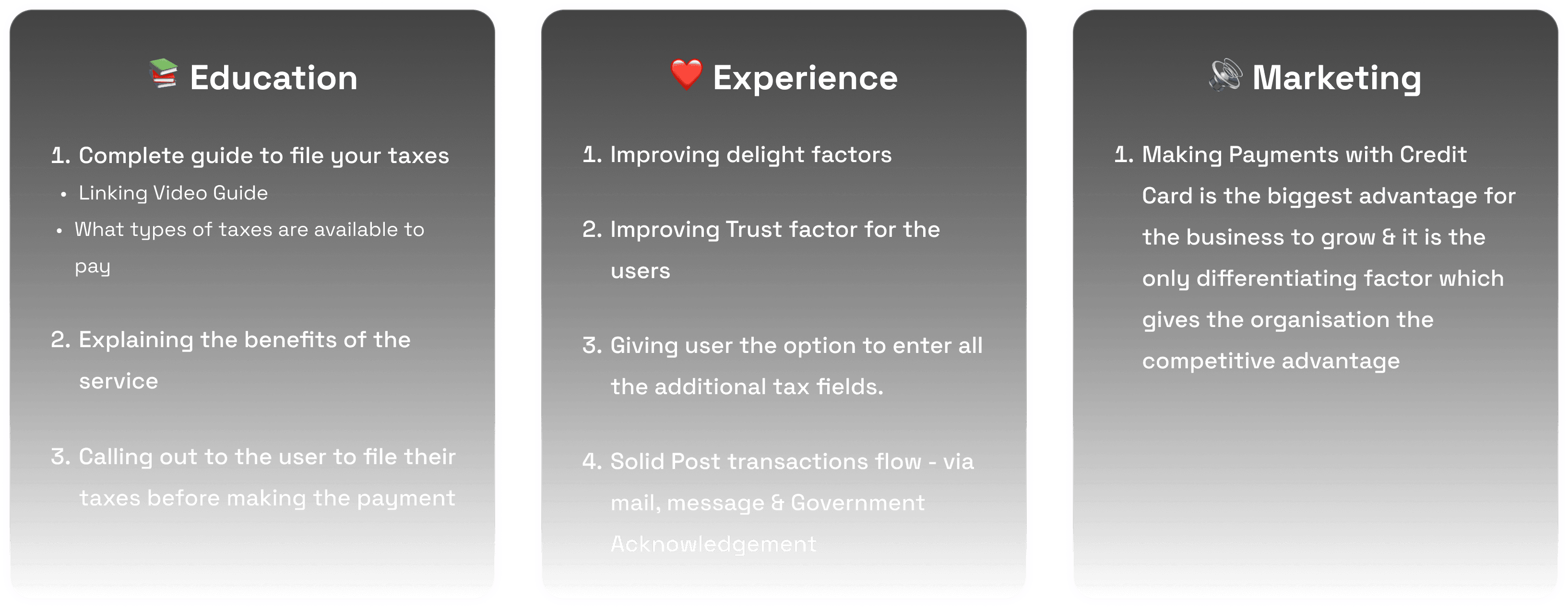

Evaluating User needs

Simplified User flow

User guidance & Education

Security Assurance - TRUST

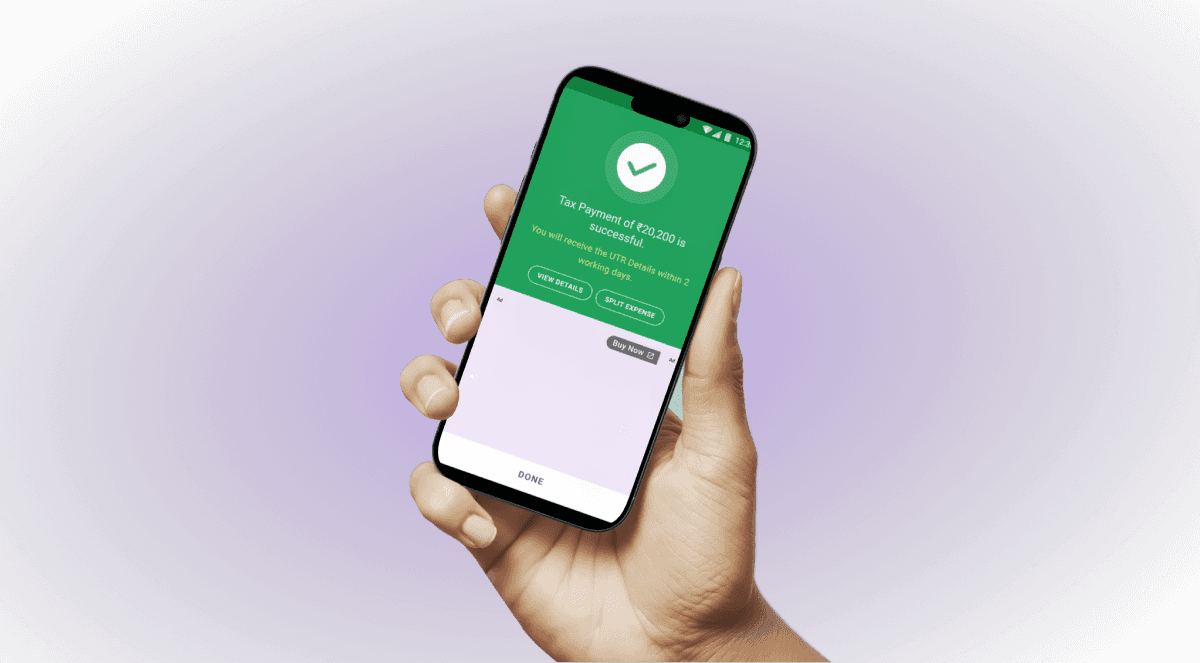

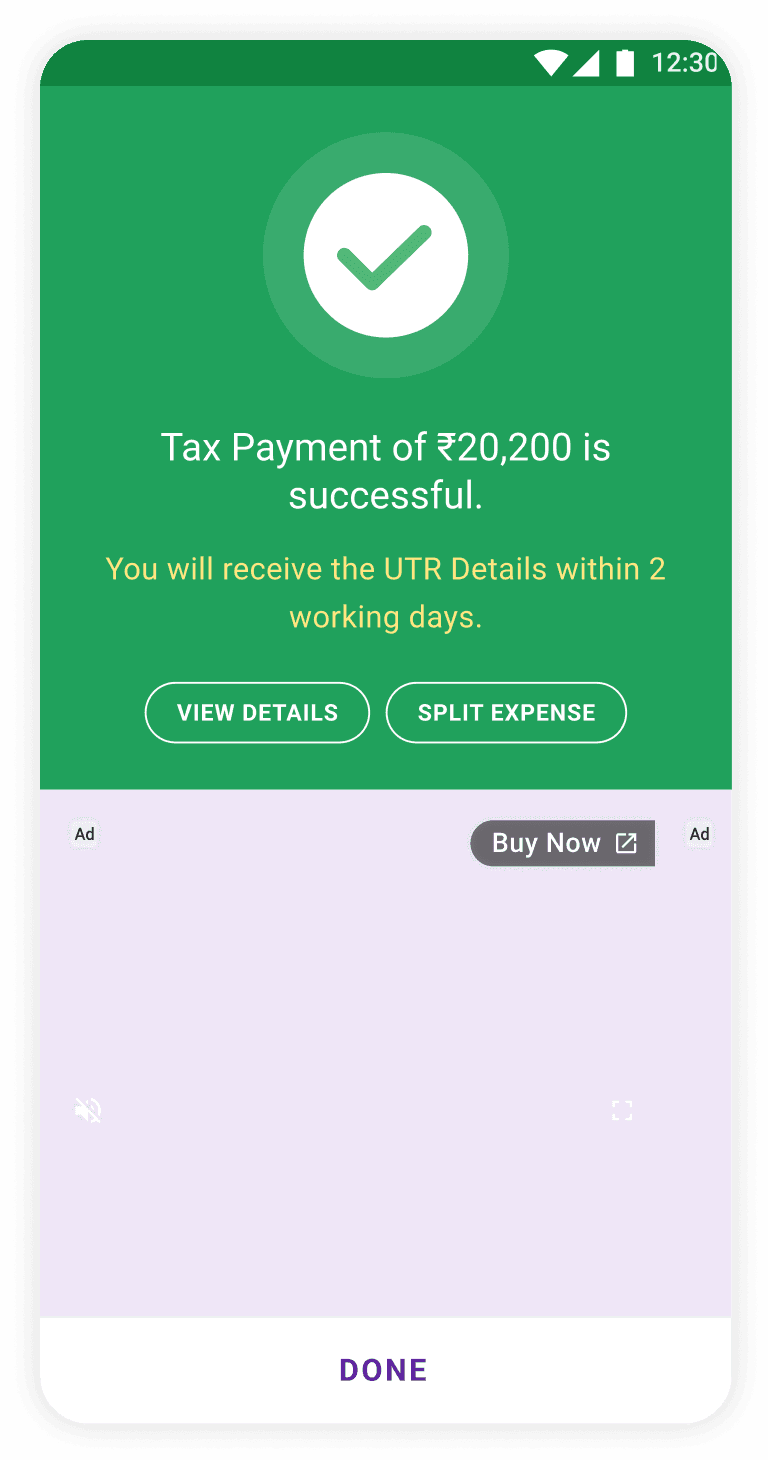

Post Transaction Information

Simple Payment Proccess

Ideal User Flow

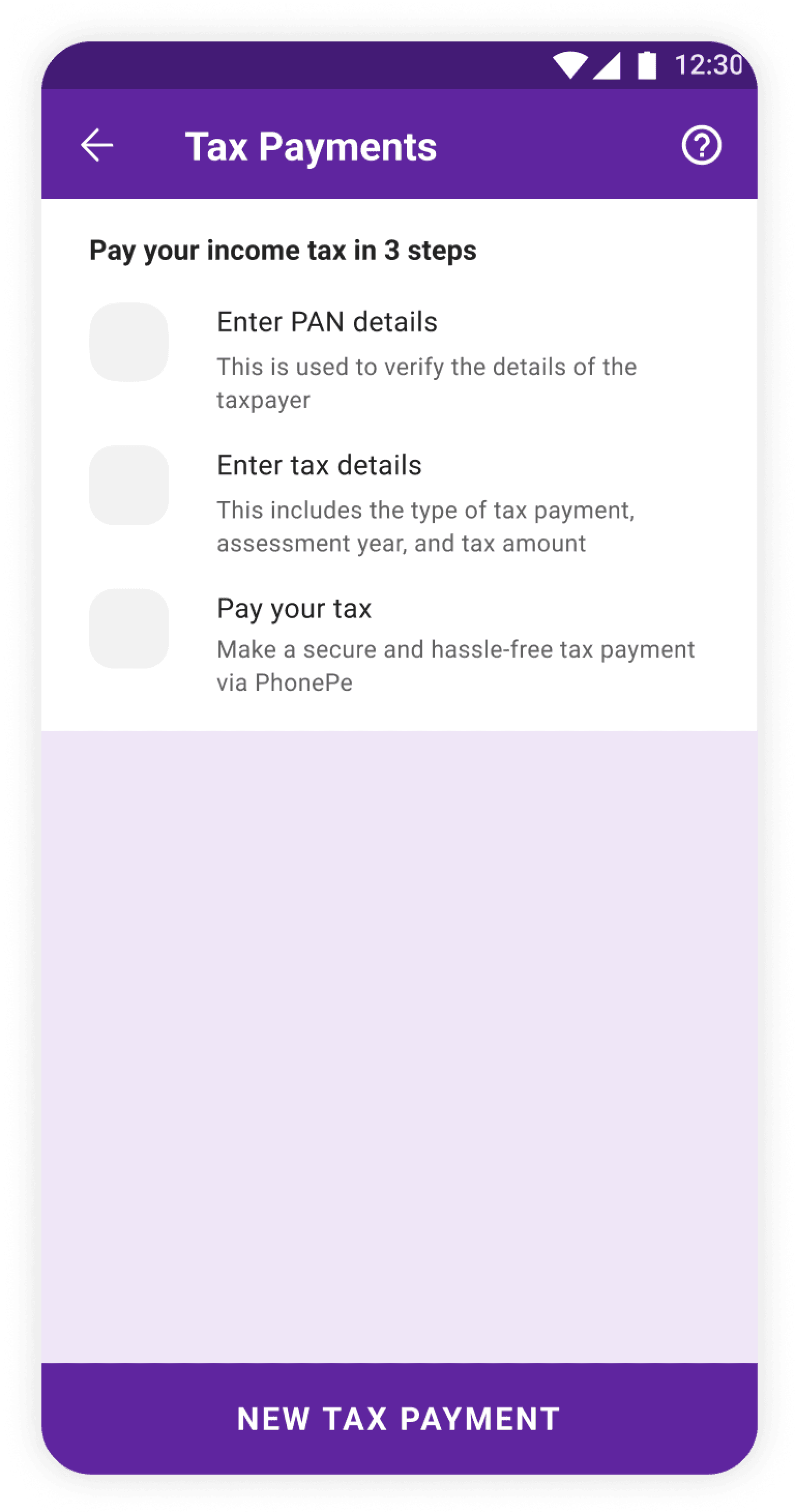

What went live?

Educating the user

Pre-selected Tax Details

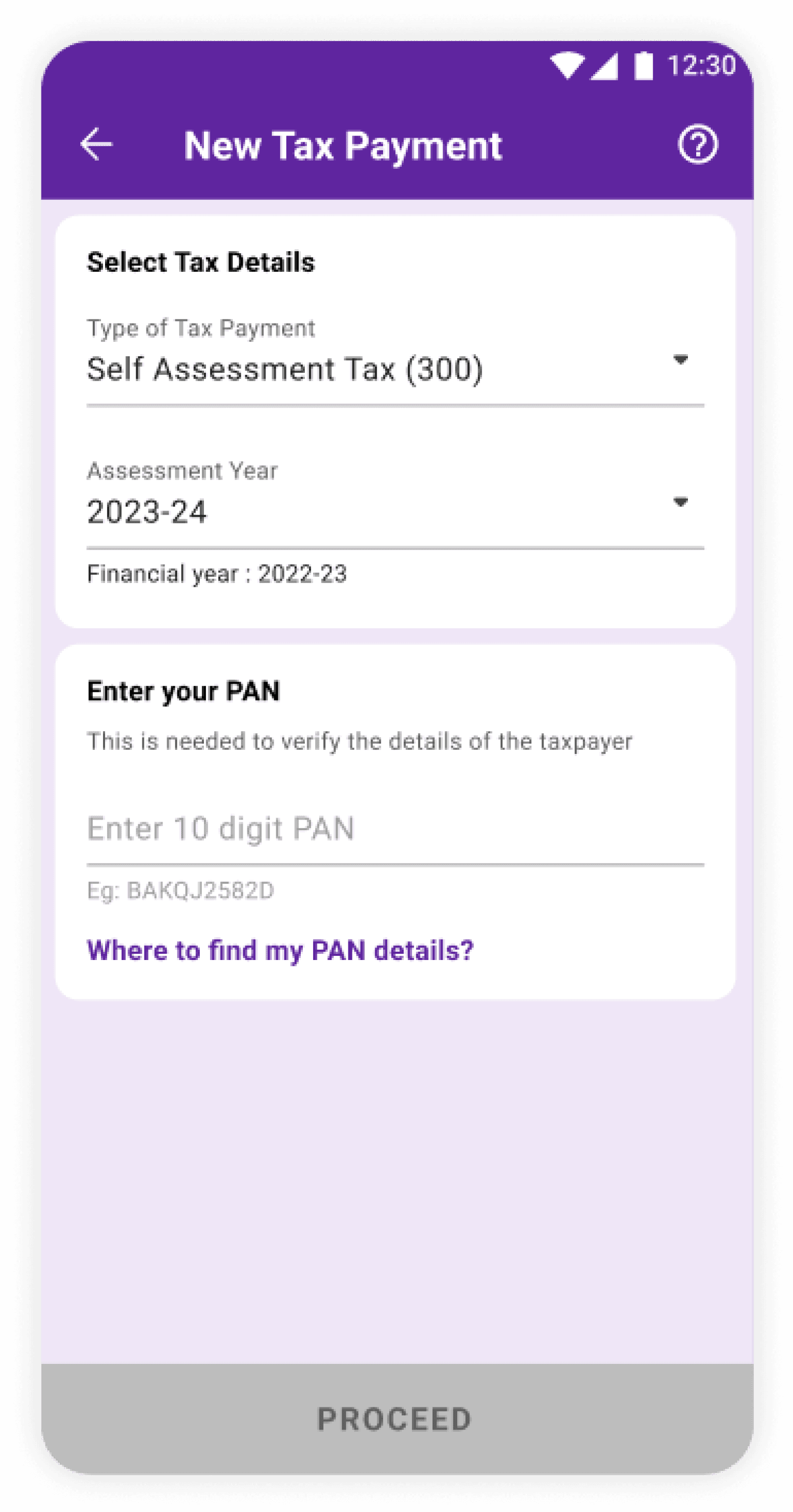

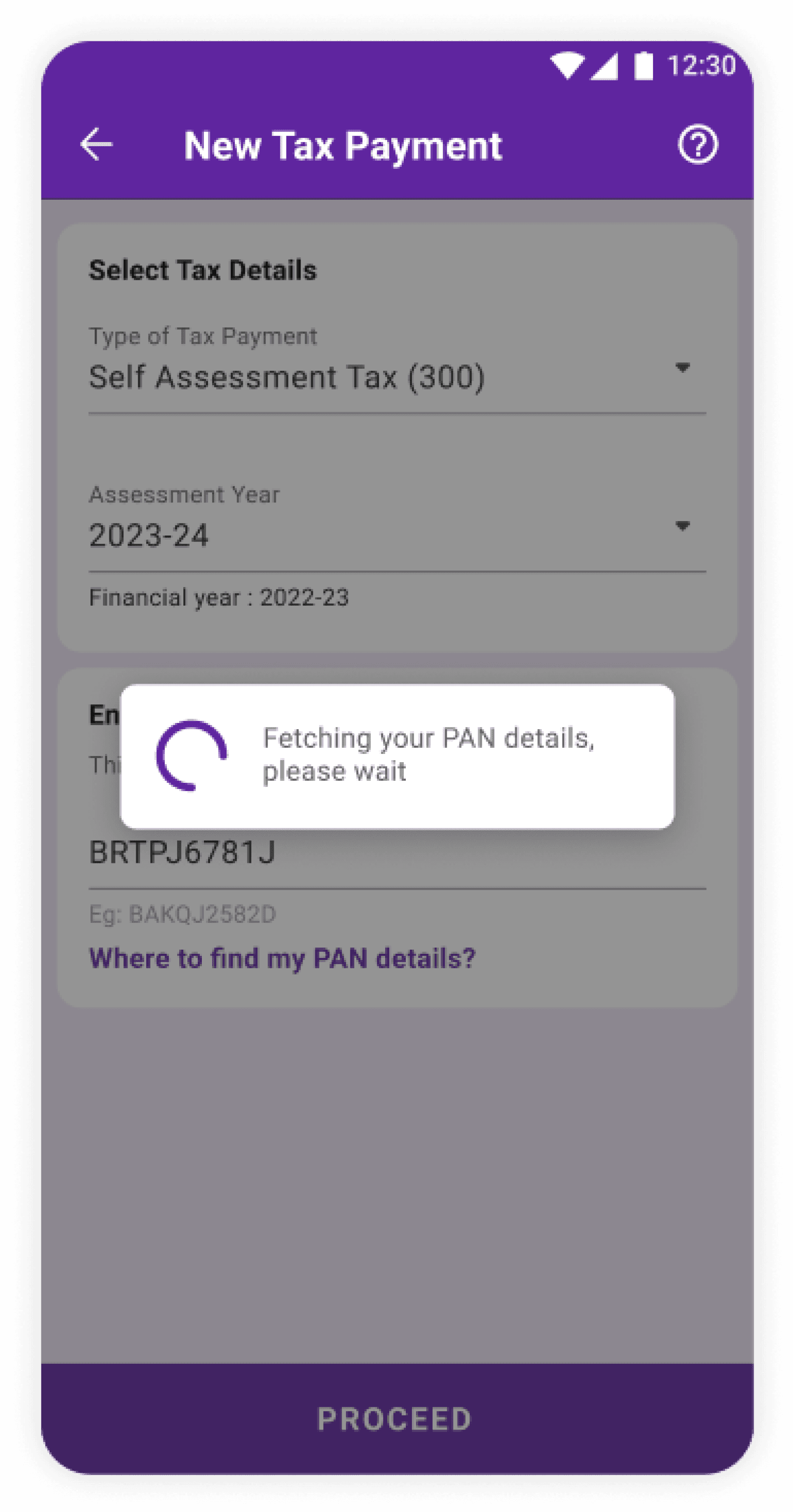

User Enters PAN Details

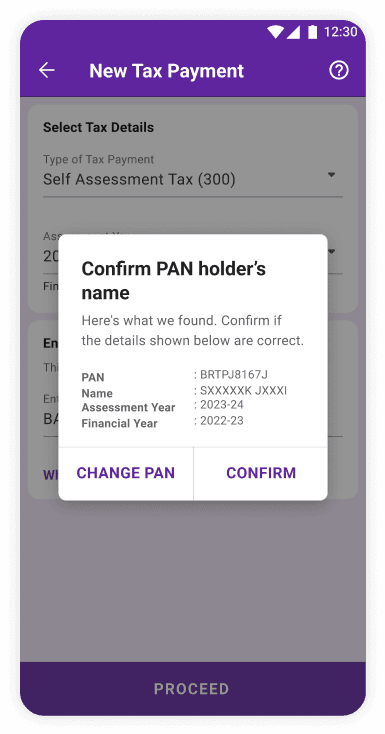

Confirming Sensitive information

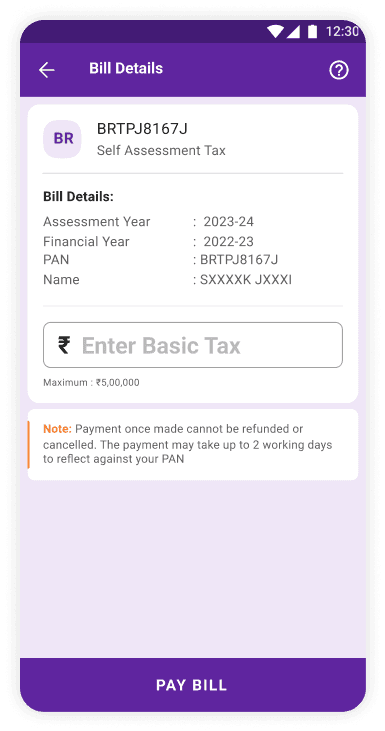

Entering Tax Amount

Impact

This feature was rolled out and enabled for

5M+

Clicks made by users within 1 month

110K

Transactions made within 1 month

19K

To support future versions

Developed a flexible framework

Improvments

Few things can be improved